Mainnet Launch : aeBridge, aeSwap & Liquidity Farming

I. DeFi on Archethic

II. aeBridge

a) Functionality Overview

b) Safety module

c) Operational Phases

d) Fee model

e) Bridgable Assets Overview

III. aeSWAP & Liquidity Farming

a) Functionality Overview

b) Fee Model

c) Dynamic Fee

d) Liquidity Pools

e) Yield Farming and Incentives

f) Farming Incentive Phases

I. DeFi on Archethic

The launch of DeFi on Archethic marks a pivotal chapter in our saga, transforming the blockchain landscape we took years to build into a live playground for innovation.

The bridge represents the portal to our native chain.

In a deliberate move to accelerate ecosystem expansion, we have also deployed our proprietary DEX enabling immediate engagement and contribution from day one.

This initiative underscores our commitment to fostering an environment of innovation and collaboration, paving the way for the future of decentralized finance on Archethic !

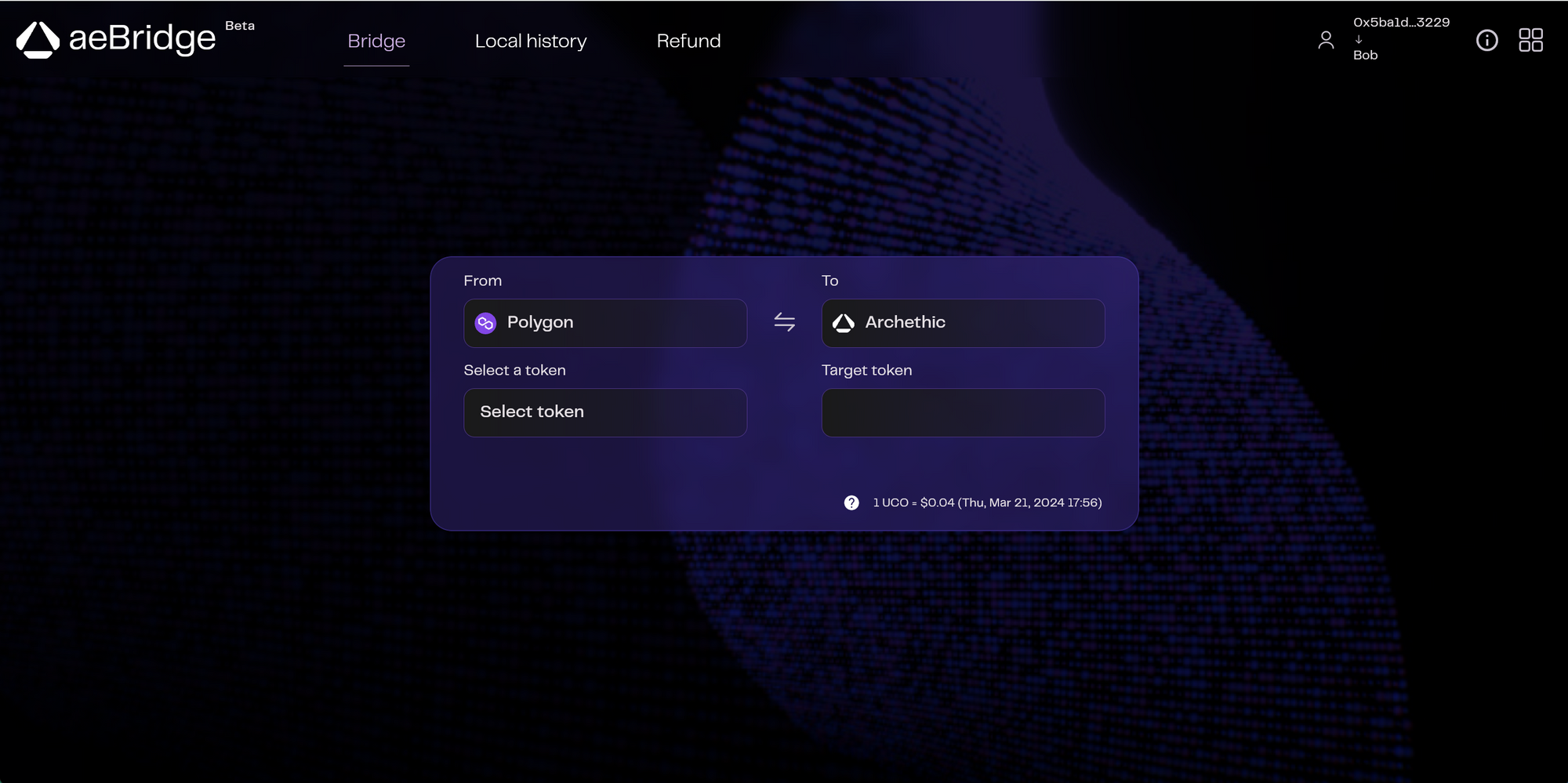

II. aeBridge : The Gateway to Archethic Chain

a) Functionality Overview

aeBridge offers a secure and intuitive portal to transfer assets to Archethic native chain. Employing an atomic swap model alongside a user-centric interface, we ensure the highest level of security while keeping in mind that a friendly user experience is paramount.

b) Unique Safety Feature

Understanding the high risk of exploits in Layer 1 bridges, we’ve introduced a Safety Module. This is a dynamic risk mitigation tool, funded by transaction fees, designed to enhance protection against exploits.

c) Operational Phases

- Phase 1: Initial funding for the Safety Module is provided by Archethic

- Phase 2: Bridge revenues gradually replenish Safety Module funds

- Phase 3: Bridge revenues increase safety module total value reducing withdrawal delays as refill operation is manual

- Phase 4: safety module reach satisfying amount & bridge fee is reduced to fit market standards

d) Fee model

EVM => ARCHETHIC

Fee : 0.8%

- 0.5% to Safety Module, creating a reserve to secure funds against potential breaches

- 0.3% for Archethic to allocate towards ecosystem expansion

// Deposits are automated & instantaneous //

ARCHETHIC => EVM

Fee : 0.3%

- 0.3% for Archethic to allocate towards ecosystem expansion

// Withdrawals are automated & instantaneous, nevertheless the refill of the bridge pool is manual //

e) Bridgable Assets Overview

The initial assets bridgeable will be

- WETH (Polygon PoS)

- UCO (Polygon PoS/ETH/BNB CHAIN)

Archethic plans to introduce a broader array of assets, especially stablecoins, to enhance the diversity and resilience of our ecosystem.

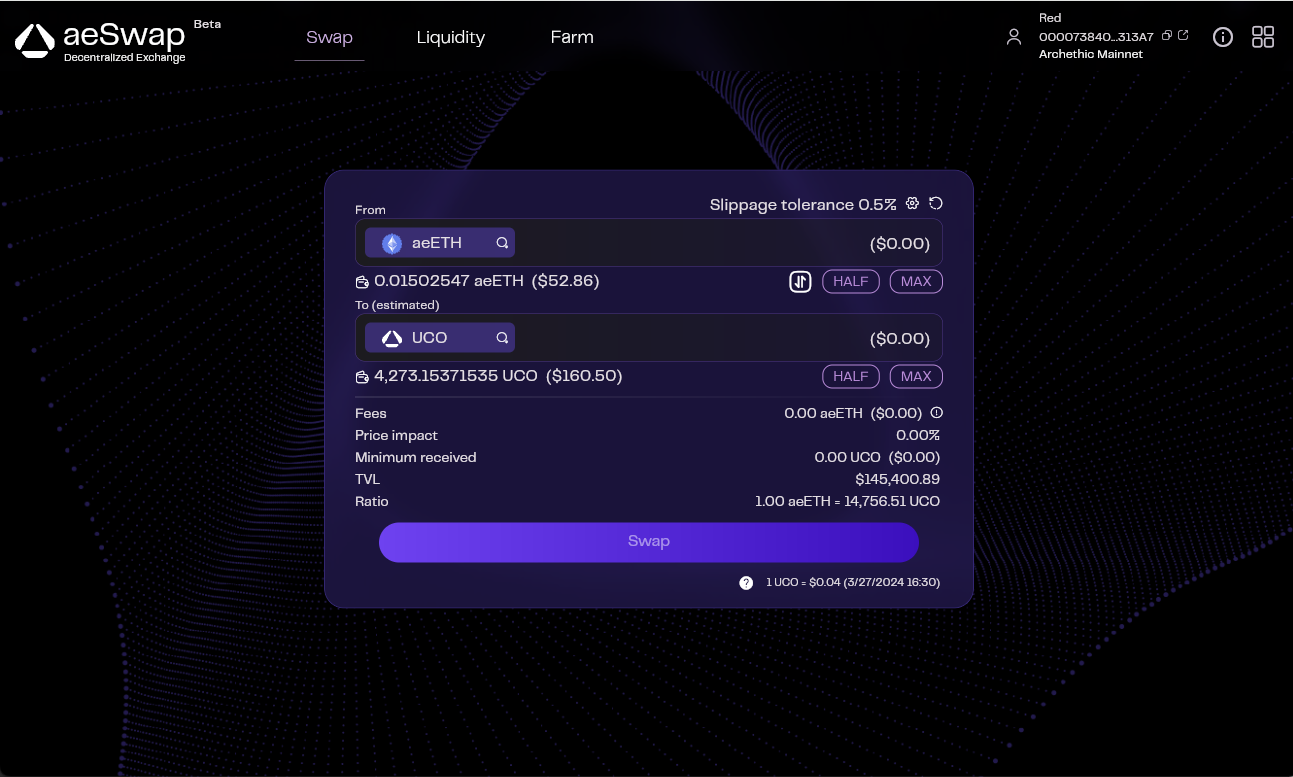

III. aeSwap : Native Assets buy & sell

a) Functionality Overview

aeSwap is a DEX leveraging the Uniswap V2 Automated Market Maker (AMM) model, battle-tested & resilient to ensure functional ecosystem growth.

b) Fee Model

Fee : 0.5% - 0.35% per swap

- Liquidity Providers: 0.25% rewarding their contribution to the pool.

- Liquidity Funding: 0.25%-0.10% creating a steady liquidity expansion towards the stability of our ecosystem.

The greater the trading volume, the more liquidity available to support our ecosystem's resilience and capacity for growth.

c) Dynamic Fee

Fee reduction inversely proportional to liquidity added by community.

0 - 300k : 0.25%

300k - 600k : 0.20%

600k - 900k : 0.15%

900k+ : 0.10%

We plan to sustain this fee model up to meeting criterias to list on T1 exchanges, after which we will align with market standards to ensure competitiveness and long-term value for our users.

d) Liquidity Pools

The initial pool to be introduced will be aeETH/UCO, funded with $100,000+ in total liquidity by Archethic.

As we progress, Archethic and the community will jointly initiate more pools, expanding our ecosystem's diversity and robustness.

e) Yield Farming and Incentives

Participants who contribute liquidity are granted LP tokens, which confer a right to a portion of the transaction fees — 0.25% from every transaction — as passive income.

Additionally, these LP tokens can be deposited in the aeETH/UCO farming pool, allowing participants to earn $UCO rewards in recognition of their contributions to the liquidity pool.

f) Farming Incentive Phases

- Phase 1:

2.5 million $UCO rewards to liquidity providers (LPs) during the initial two months. Rewards are dynamically allocated, calculated by the second, according to each participant's share in the pool. - Phase 2:

6.5 million $UCO will remain in the reward pool, set to be distributed over the following 10 months, allowing dynamic allocation guided by market evolution.

Our incentive model is meticulously crafted to ensure strong liquidity foundations, essential for our ecosystem's growth. We've carefully considered the impact of impermanent loss, striking a balance within our reward calculations to mitigate its effects while still offering compelling returns for our community members.

Archethic Public Blockchain

Archethic is a Layer 1 blockchain that seeks to empower people over data ownership, decentralized applications over slow internet, and cost-effective energy solutions over expensive carbon emissions.

Due to the use of a new consensus called "ARCH," its blockchain architecture is the most scalable, secure, and energy-efficient solution on the market.

With the addition of an internal oracle, time-triggers, editable content, and interpreted language; Archethic smart contracts broaden the capabilities of developers and builders!

Archethic provides an open and interoperable ecosystem for all blockchains with native integration for Defi, NFTs, and decentralized identities.

Let us work together to empower Archethic

Archethic Foundation: Non-profit to manage decentralized governance of the public blockchain

Do you want to learn more?

White Paper

Yellow Paper