7 reasons to use Archethic's Smart Contract in your business

Smart contracts are simply programs stored on a blockchain that run when predetermined conditions are met. Smart contracts are in computing what robots are in real life: they perform actions according to events.

Compared to smart contracts offered by other Blockchains, Archethic Smart Contracts open a new world of use-cases for Businesses and Developers that were unachievable on different Blockchains.

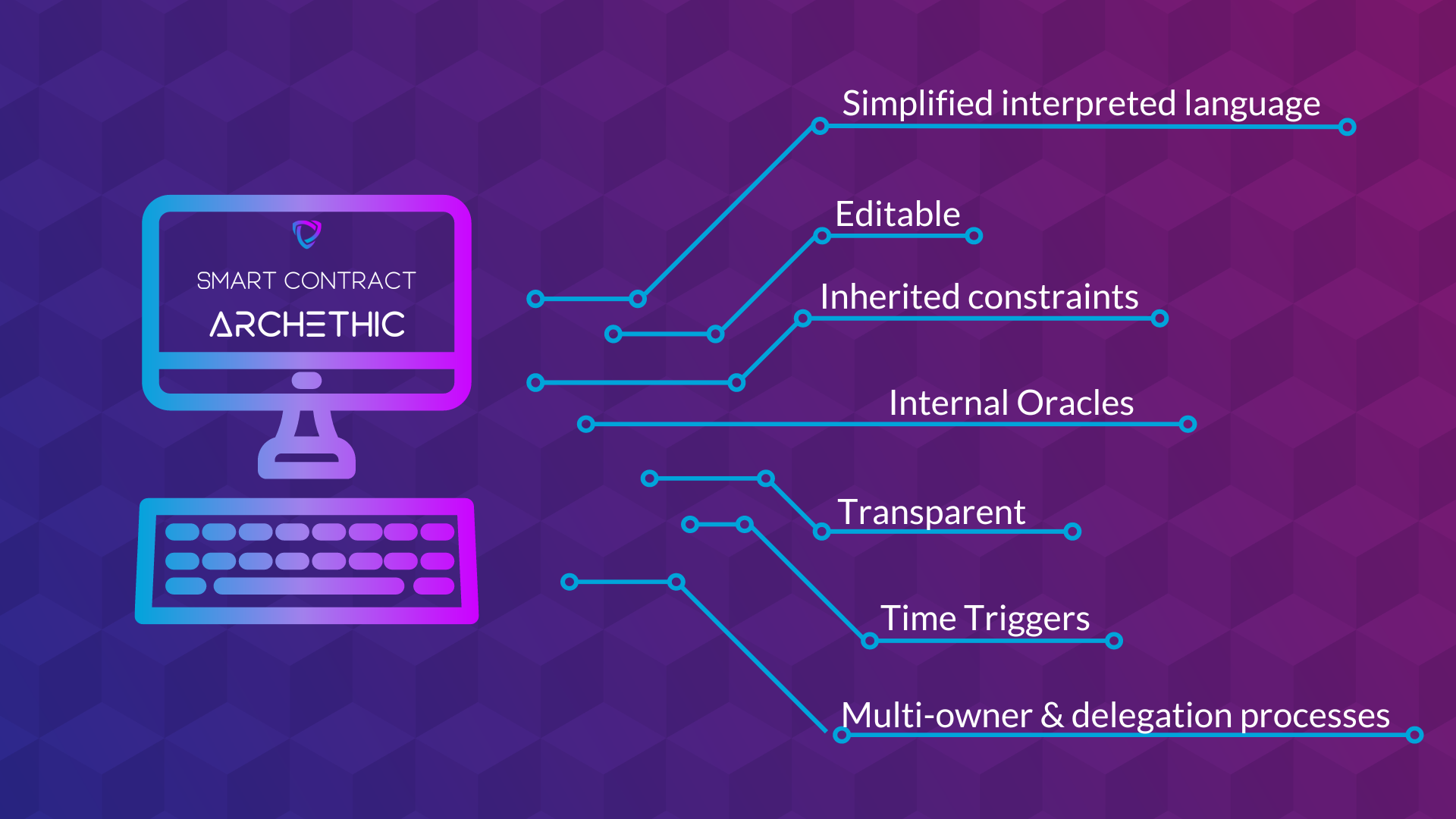

The reasons that make them the first of their kind for developers and businesses are

- Archethic blockchain is coded in Elixir. Archethic Smart Contract is coded in a simplified interpreted language closed to specification (Domain Specific Language) because we wanted developers around the world to be able to develop Dapps within days.

- When a Smart Contract is deployed on other blockchains, it is complex to modify or update it. Archethic Smart Contract code is editable. Developers can edit the code of a smart contract after deployment.

- But if you can modify the Smart Contract code after deployment, what if anybody could run off with a liquidity pool? We have also solved that, inherited constraints enable some parts of the transaction chain to be unlocked. Once locked, it is forever.

- To reach external data on a blockchain like Ethereum, you need an oracle like #Chainlink. Archethic provides internal oracles, you can receive event of dataset directly from the blockchain.

- Any Smart Contract code is open source and public. Thanks to the interpreted language, the code is directly understandable by human and computer, allowing real-time analysis of the execution, reducing the risk of security.

- Even for leading Blockchains like Ethereum, you can’t program an action at a specific time in the future. Archethic provides “Time Triggers”, giving you the ability to program any action at a specific time.

- Smart Contract multi-ownership security is a challenge. Archethic gives the ability to create multi-owner Smart Contract & delegation processes, hence providing enhanced security through native End-To-End Encryption (E2EE)

A top Smart Contract provided by a Blockchain platform like Archethic can add value across various industries because it can be adapted and shaped based on changing business requirements. For businesses and teams looking to develop a Dapp on Archethic? Everything you need to know is in our SDK .

Now that we have a clear idea about what Archethic Smart Contracts are and what benefits they have to offer. It is time now to deep dive into a sector, and understands possibilities in a specific industry with the implementation of Smart Contracts.

Let's look at the Financial Sector, where Archethic Smart Contracts can create an impact

Derivatives

Financial Contracts are those that have the value of an underlying asset changed. The most common assets are Stocks, Bonds, Currencies, Commodities and Market Indices. The underlying asset's value changes according to market conditions. The basic idea of entering into derivative contracts is to make money by guessing how much the underlying asset will be worth in the future.

The 3 major types of derivative contracts are Options, Futures, and Swaps.

- Options are derivative contracts that give the buyer a right to buy/sell the underlying asset at the specified price during a certain period of time.

- Futures are standardized contracts that allow the holder to buy/sell the asset at an agreed price at the specified date. Forwards: Forwards are like futures contracts, where in the holder is under an obligation to perform the contract.

- Swaps are derivative contracts, where in two parties exchange their financial obligations.

Smart Derivative Contracts are viewed as a solution that can enable more effective monitoring and execution of complicated and big derivative contracts, which are often based on thorough and thoroughly standardized master agreements.

For instance, payment-related clauses in a derivative contract that mandate automatic execution upon the occurrence of particular events and demand one party to pay a specific amount to another party can be programmed into a smart contract. Archethic Smart Contracts are easy to create and modifiable and HENCE can incorporate external information (such as exchange rates required for the calculation of payment amounts based on pre-defined calculation methodologies) meaning that external information may be integrated into the Smart Contract itself.

Decentralized Finance (DeFi)

A rising segment of the financial services sector is known as DeFi and is one that is most talked about. As compared to the traditional, heavily centralized infrastructure, DeFi uses Smart Contracts to provide financial services on a bilateral basis, between the service providers and their customers.

Archethic smart contracts can ensure that each transaction is legitimate, transparent, and trustless and being executed according to the predetermined provisions of the agreement. Plus any last-minute changes and addition and modifications can also be implemented as our Smart Contracts are actually editable.

Another innovative feature that we can be integrated is, for example, DeFi users require access to reliable price feeds to know that the value of a digital asset is accurate and free from outside manipulation so that they can safely and confidently transact in a decentralized environment. Unlike other #blockchains, where to reach external data on a blockchain like Ethereum, you need an oracle like #Chainlink. Archethic provides internal oracles, that can be linked to trusted, verified data from multiple sources and can be implemented on dataset directly from the blockchain.

The market for syndicated loans

Another sector of the financial services sector that can be particularly beneficial for the application of Smart Contracts is the Lending market. Participants in the Loan Market CAN USE Smart Contracts as a suitable strategy that could, through the automation of specific processes, make the management of loan transactions more efficient due to the numerous different documents that accompany them (such as inter-creditor agreements, facility agreements, security agreements, etc.). In addition to automating data and payment flows resulting from the parties' contractual responsibilities, smart contracts can also automatically verify the parties' adherence to their contractual obligations (such as adherence to financial statements and, delivery of necessary papers and information).

Traditional Banking Industry

In the banking sector, multiple lenders provide loans to multiple borrowers on the same loan terms and have much to benefit from using smart contracts. With several entities involved, due diligence becomes of utmost importance to avoid fraud. Smart Contracts can automate and execute KYC processes for multiple parties in a hassle-free manner using pre-defined terms and conditions.

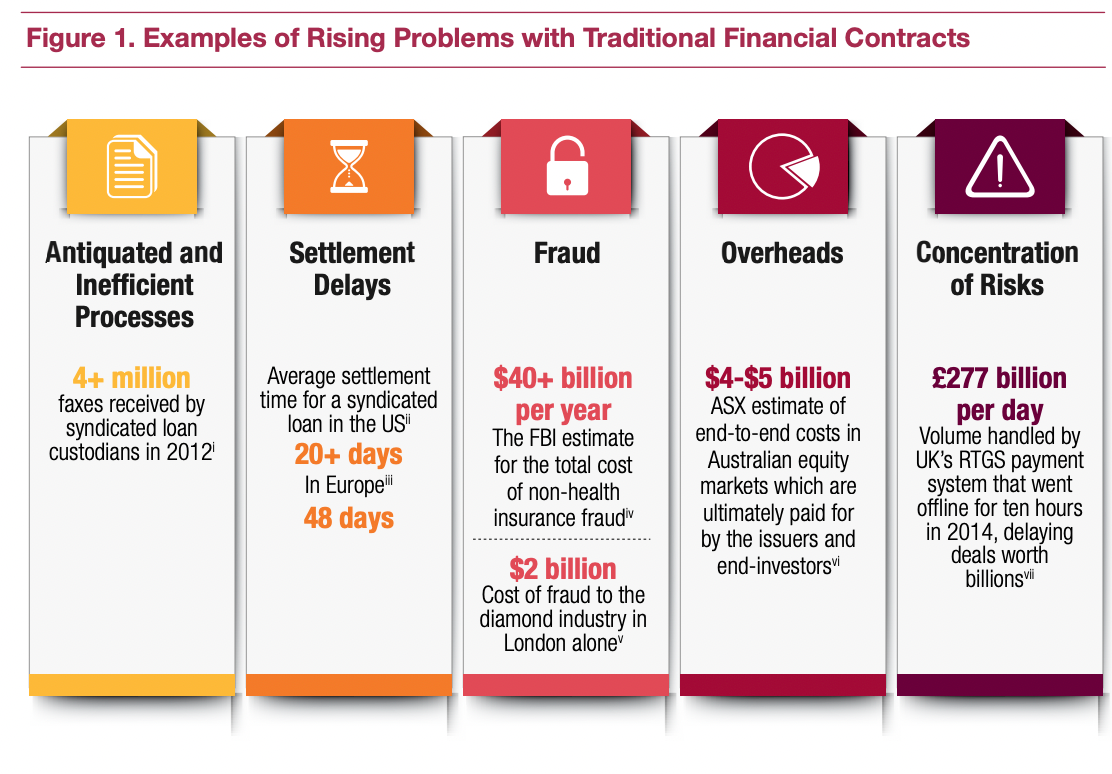

Likewise, let's look at the other rising problems in the Banking Sector

With the use of Smart Contracts in the Banking Sector. Corporate clients may benefit from faster settlement cycles when trading and settling syndicated loans. Our Smart contracts could reduce this from the current 20 days or more. Future demand growth may result from this, generating an increase in revenue as well. Additionally, operational costs for investment banks in the US and Europe would decrease.

The adoption of Smart Contracts will have a substantial positive impact on the Mortgage Loan Sector as well. Banks will save money by reducing processing and overhead expenses in the origination process, and consumers could anticipate savings per loan by avoiding unnecessary charges.

Insurance Industry

Archethic smart contracts bring insurers, customers, and third parties to a single platform, and reduced claim processing time and cost. Also, third parties such as transport providers and hospitals once they are part of the distributed ledger – will be able to provide quicker support against claims to customers and can expect faster settlement of claims. A recent data report by Capgemini Consulting suggests that based on the UK motor insurance market in 2020, annually $21 billion could be saved by the motor insurance industry through the use of smart contracts to improve efficiency and bring the speed of execution to processes.

Now let's turn to practice

Create your first Archethic Smart Contract following our developer's guide ➡️

Conclusion

Our objective with this article has been to provide a solution for the financial industry with the benefits of the Smart Contracts.

The Blockchain landscape is huge, and it's important to distinguish between hype and reality in the field of smart contracts, as with any game-changing development. Archethic Smart Contracts provide an exhilarating, transformative possibility that can help your organization across a range of collaborative smart contract initiatives.

Archethic Public Blockchain

Archethic is a Layer 1 aiming to create a new Decentralized Internet.

Its blockchain infrastructure is the most scalable, secure & energy-efficient solution on the market thanks to the implementation of a new consensus: "ARCH".

Archethic smart contracts expand developers' boundaries by introducing internal oracle, time-triggers, editable content & interpreted language.

Through native integration for DeFi, NFTs & decentralized identity; Archethic offers an inclusive and interoperable ecosystem for all blockchains.

To achieve the long-term vision of an autonomous network in the hands of the world population, we developed a biometric device respecting personal data privacy (GDPR-compliant).

Making the blockchain world accessible with the tip of a finger. Be the only key! https://www.archethic.net/

Archethic Foundation Non-profit to manage decentralized governance of the public blockchain

Do you want to learn more?

White Paper

Yellow Paper